Oftentimes, I feel as if I’m living through a show of MythBusters. Let me provide you with a quick overview if you’ve in no way seen this popular present that’s on the Discovery Funnel. The show circulates a couple of groups of guys and ladies who run elaborate testing (based on science) for you to prove if long-standing gossip, old wives’ tales, astounding stories and myths are generally true or not.

For example, the most popular episode is when they had the ability to prove that cell phones, iPods or maybe laptop computers do not affect airline flight instruments!

Now, I’m not really a scientist by any extent of my imagination. However, I am constantly myth-busting when it comes to the markets. In fact, just a couple of weeks back, at a party, I was dispelling myths about options trading.

It is where I fulfilled Ian, a successful young man (in his mid-30s) who owns two dental methods. When Ian asked me about things I do for a living, We explained to him that I train people in an efficient, more rewarding way to make money with less danger.

I went on to explain in order to him that I use choices to create risk/reward scenarios that shift the probability associated with success in my favour. Naturally, he thought options had been riskier than stocks or maybe mutual funds.

And consider me, I’ve heard all this before; options leverage is usually dangerous, they are too challenging, they are good for trading not necessarily investing, they lack ease of purchase and sale and trading costs are generally too damn high.

Aren’t getting confused. Some of these concerns seem to have been legitimate… that is, back in 94. Fast-forward 20 years and these reasons simply don’t hold correct anymore. I told Ian, that most investors (and actually most investment professionals) believe the same. The overall industry as well as investment education is still trapped in the 90s.

You see, this hasn’t been until recently that options have become viable options for investors. This is primarily due to improvements in electric trading platforms, analytic tools, technologies and competition amongst trades to create better pricing.

I realize a mouthful, right? Nevertheless, all these aspects benefit anyone, the investor.

In addition, brokerage firm houses are fighting similar to hell for your business, setting up a price war, which performs in your favour in the form of more affordable commissions and transaction service fees.

Imagine being an “old school” investment professional now being forced to learn about options. These “pros” are so stuck in their outdated ways; that they’ll do anything for you to discourage you from trading/learning with regards to options.

It’s true… We’ve witnessed it with my own, personal eyes.

For example, a couple of years past I was asked to consult with a tiny hedge fund ($100 thousand in assets) about employing option strategies to smooth out in addition to enhancing performance.

When I kommet down with the fund administrator, I started explaining many techniques that they could get started implementing. Of course, he was nodding his head as if he previously liked what I was telling him.

However, I knew that there seemed to be something missing… my digestive tract was telling me we were not on the same page.

Moving forward, I started to ask several questions, only to discover that he or she didn’t even understand the big difference between a call and also option (the very first principles you learn about options)… I got floored!

My shock began to turn into slight anger. The thing is, people, put their salary and trust into fund managers like this all the time. I remember thinking they owe to their clients to work challenging to try to achieve the best effects possible.

It still will fire me up to this day… thinking of that meeting.

In all justness, it wasn’t his negligence. The mutual fund in addition to the hedge fund business model is definitely broken. Sure, their field might sound sexy, but all they’re doing is providing and collecting assets for just an (undeserving high and sometimes hidden) fee.

Let’s face the item, we’ve all been vetted on the idea that we need to hand over all of our money to an investment skill. That they’ve got a plethora of exploration, proprietary models, signals and also the precise product information that give them an edge… figuring out when to buy low market high… yadda, yadda, yadda.

News Flash!

Less than just one per cent of managers have got beat index funds during the last ten years. Please, go back and also read that sentence once more.

O. K. good: That’s right folks… and that’s not merely me saying it, this specific hard-to-swallow statistic arises from Motley Fool. In fact, in accordance with their study in 2013, only ten of five thousand actively managed shared funds were able to beat the S&P consistently over the past decade.

Similar to a lamb to the slaughter.

Don’t forget, that these funds have to be thoroughly invested at all times. Nothing would make their greed glands retiré more than the management fees many people stiff you with. Cardiovascular disease money invested, the higher often the fee they collect…

Currently, when I asked Ian the way this broken model seemed to be working for him… he easily told me, “Josh, it’s not”. I agreed to meet up with Ian at a local Starbucks to stay our discussion at a later date.

Affirmed, a couple of weeks passed and there is Ian at Starbucks, on time as we planned. Coming from our previous discussion, he or she told me that he knew nothing at all about options.

However, he or she did want to make his funds work harder for the dog. In addition, he was open to researching a better, more efficient way to increase his wealth. After all, he’d invested $200, 000 in a number of mutual funds with subpar results.

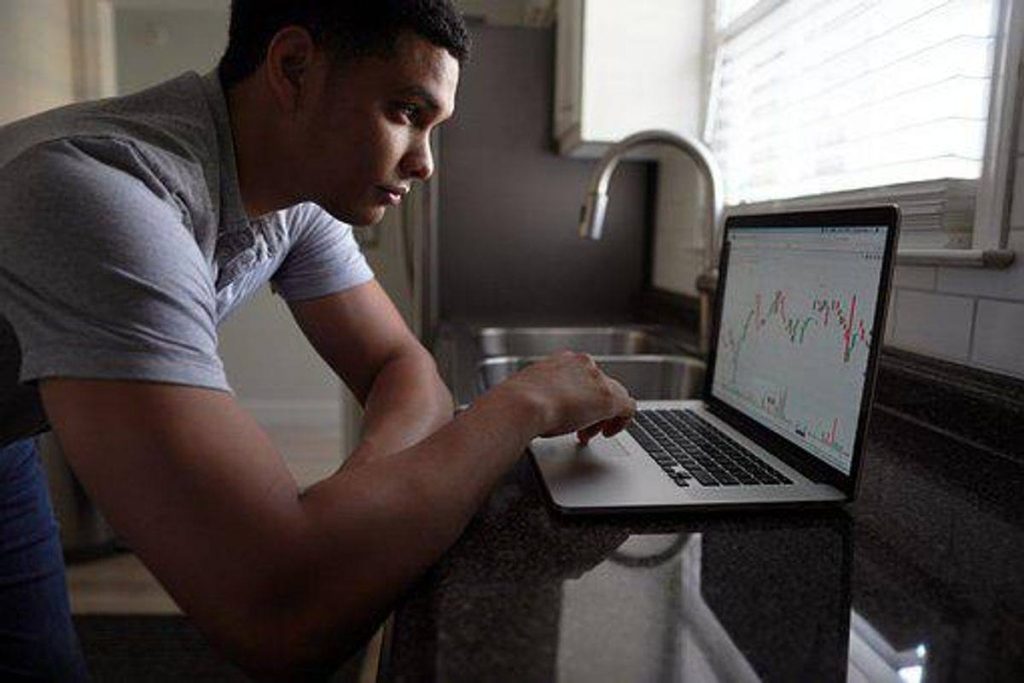

As with anyone My partner and I teach, I went into the basics behind options and exactly how they’re used to achieve unordinary results… all while skewing the risk/reward in your favour. My partner and I later busted out my very own MacBook and logged in to my options trading platform.

Initially, I showed him what exactly an option chain is (options jargon for a list of all tradable options for a particular stock)… I noticed his eyes come to gloss over.

Believe my family, learning about options at first can be very overwhelming. There is no disgrace if you “don’t get it” right away. In fact, I’d end up being surprised if you pick up the particular ball and run.

In fact, the reason why most investors adhere to stocks and mutual cash is that they are so darn easy. It’s the same thing when you attend the casino and become between so many slot machines. Needless to say, from the game where the casino has got the biggest edge.

You see, along with stocks, you either enter a trade short and you have a 50/50 shot of making money. But with options, you can produce odds in your favour from 63%-92%.

Look, I understand options are difficult and there is a learning competition, but if you can create better possibilities for success with options when compared with stocks, why wouldn’t you take very little extra time to learn?

Heck, As a former doing it for a decade at this point and still continue to learn. Allow me to share the four reasons why you should think of:

Leverage- Use less money to accomplish higher returns. Options give you better use of capital plus a better return on investment (ROC)

Better odds rapid Structured option strategies can cause more favourable probabilities of good results than equities

Reduce chance – Structured option techniques will create max loss situations before entering the deal. You also reduce risk by utilizing limited capital and not completely invested.

Versatility: With choices, you’re not vulnerable to any particular market condition. For example, you will find strategies for high-volatile markets, low-volatile markets, and trending and sideways markets. With stocks an individual always has to make a directional bet.

Right now, when I explained to the CFA study: hedge fund manager these reasons, this is what this individual told me:

“Josh, this almost all sounds good, but with exactly what you’re suggesting we would not possibly be fully invested. Our business is based on fees and we take advantage of being fully invested. inch

“We’d like to achieve a great deal better returns for our clients, nevertheless only slightly better intended for marketing reasons. We no longer want to do that good for our consumers, because they might not believe the idea and we don’t benefit. Each of our compliance officers suggested options too risky and we will have to re-evaluate all of our clients. very well

This is the reason why I need to instruct people like Ian so you, a better… more successful way to make an investment because these people aren’t those anytime soon. And, remember, I’ll continue to debunk typically the myths about options along with investing to all my audience.

In fact, I’ve decided to do one better. After training thousands of students and addressing countless emails… I started to notice a pattern within the questions I was receiving… many of them sounded the same. I could feel that investors wanted to find out about options, but were concerned that they just wouldn’t have them.

You see, options can be very complex if you’re not given the correct direction… and if you’re like lots of people, you’re busy with function, family life and sustaining health. Let’s face this, we just don’t have exactly the same free time we did because of kids.

That’s why I a new super-easy-to-understand book, integrated out all the noise, exclusively geared towards those interested in which makes the transition to options making an investment… for quick and easy results.

It’s called Reckless Income For Leverage, a thing I’m very proud of. U want anyone who has ever contemplated getting involved with options to study it.

That’s why I’ve achieved it so affordable for everyone to post. Not only that, I’m so comfortable you’ll get valuable use experience (maybe even change the technique you view investing forever)…

I’m offering a 25-day, no-questions inquired, money-back guarantee if you’re not completely satisfied. Honestly, what must you lose?

Read also: